Working capital turnover ratio shows how well a business turns working capital into sales. Still, it’s important to look at the types of assets and liabilities and the company’s industry and business stage to get a more complete picture of its finances. Having a high working capital turnover means that you are good at managing short-term assets and liabilities. Determine your net annual sales by adding up your returns, allowances, and discounts. While managing receivables, it’s also vital to refine accounts payable strategies. Negotiating better terms with suppliers can extend the time your capital is working for you before it must be paid out.

Beyond AI – Discover our handpicked BI resources

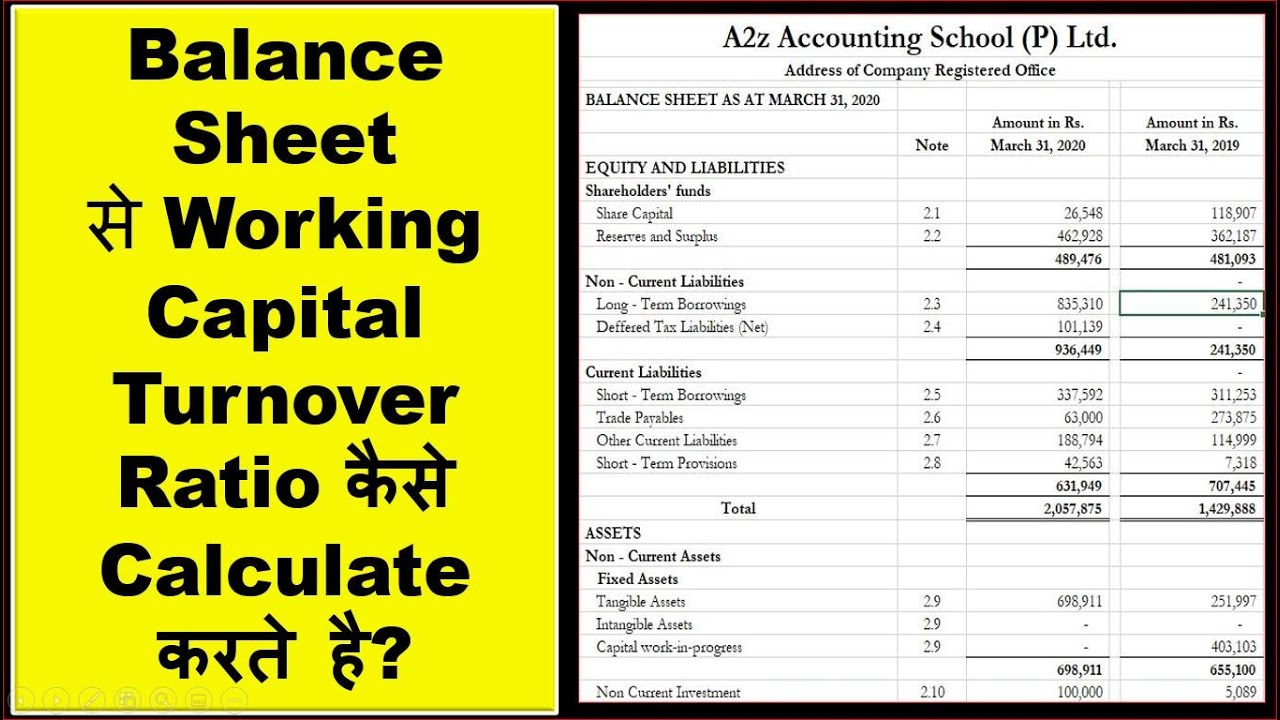

Okay now let’s consider an example so you can see exactly how the WC turnover ratio works. Ratio between net sales and working capital of a business is known as Working Capital Turnover Ratio. A lower than the desired ratio shows that the working capital is not optimally used to generate sales & optimization may be required. However, when a company’s working capital turnover is significantly higher than its peers, there is a chance that the company does not have enough working capital to support its growth.

The Latest in Money

- Industries with longer production cycles require higher working capital due to slower inventory turnover.

- By doing so, Apple has been able to boost its profit margins and returns on investment.

- Additionally, the working capital turnover ratio may vary depending on the industry and the nature of the business.

- A high working capital turnover ratio is indicative of efficient use of working capital, while a low ratio may indicate a less efficient use of working capital.

- We are not a comparison-tool and these offers do not represent all available deposit, investment, loan or credit products.

If Microsoft were to liquidate all short-term assets and extinguish all short-term debts, it would have almost $30 billion remaining cash. Current assets are economic benefits that the company expects to receive within the next 12 months. The company has a claim or right to receive the financial benefit, and calculating working capital poses the hypothetical situation of liquidating all items below into cash. Try to keep a larger capital cushion that protects you from getting into the negative. If your operating capital begins to dwindle, review your level of sales for areas of improvement.

Why the Asset Turnover Ratio Calculation Is Important

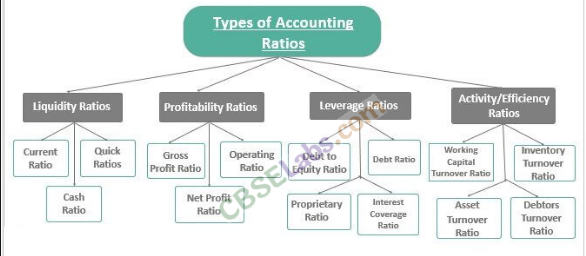

The two variables to calculate this ratio are sales or turnover and a company’s working capital. The company’s working capital is the difference between the current assets and current liabilities of a company. The working capital turnover ratio links a company’s sales and working capital. Simply put, this ratio evaluates how efficiently a company utilises its working capital to maintain its annual turnover.

How Can a Company Improve Its Working Capital?

Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law. Just upload your form 16, claim your deductions and get your acknowledgment number online.

Impact On Profit Margins

You calculate working capital by subtracting current liabilities from current assets, providing insight into a company’s ability to meet its short-term obligations and fund ongoing operations. Generally, yes, if a company’s current liabilities exceed its current assets. This indicates the company lacks the short-term resources to pay its debts and must find ways to meet its short-term obligations. However, a short period of negative working capital may not be an issue depending on the company’s stage in its business life cycle and its ability to generate cash quickly. Working capital is calculated by taking a company’s current assets and deducting current liabilities. For instance, if a company has current assets of $100,000 and current liabilities of $80,000, then its working capital would be $20,000.

No, the working capital turnover ratio and the current ratio are distinct financial metrics. The current ratio focuses on a company’s ability to cover its short-term liabilities with its short-term assets, providing a snapshot of its liquidity. The working capital turnover ratio, however, measures how efficiently a business uses its working capital where do i put my union dues to generate sales. A lower ratio generally signals that the company is not generating more revenue with its working capital. When the current assets are higher than the current liabilities, the working capital will be a positive number. If the inventory level is lower than the payables, then the working capital is high, which is in this case.

You’ll then be able to better gauge where your business lands on the spectrum. Now that you understand the concept of working capital turnover ratio, you might be interested in acquiring additional working capital for your business. Visit our page about the best working capital loans to review and compare offers of the online lenders we recommend. As with most profitability and performance, the context of the result is better understood when you compare it to other companies that are within the same industry or sector.

If you want to learn other indicators relevant to the evaluation of the financial condition of a company, check our debt to asset ratio calculator or operating cash flow calculator. Working capital turnover is a ratio that measures how efficiently a company is using its working capital to support sales and growth. A high ratio might put you ahead of competitors, but it’s not always trustworthy.

Several factors can affect working capital turnover ratio, including the time it takes for a company to convert inventory into sales, the company’s payment terms, and the cash conversion cycle. Adopting better cash management practices can also help improve working capital management which can lead to a higher efficiency ratio. One of the most effective ways of using the working capital turnover ratio to measure business efficiency is by comparing it with the industry average. Comparing to the industry average enables businesses to set benchmark targets and aim to exceed them by making continuous improvements in working capital management. It signifies how well a company is generating its sales concerning the working capital.