Similarly, unconventional monetary policies can have unintended consequences, such as asset price inflation or distortions in financial markets. Case studies provide valuable insights into the effectiveness of these alternative approaches. These reforms, known as Thatcherism, were accompanied by a period of low inflation and improved employment outcomes. A notable case study that highlights the limitations of the sacrifice ratio is Japan’s experience in the 1990s. However, despite the substantial increase in money supply and low interest rates, the expected decrease in unemployment did not materialize.

Understanding Solvency Ratios vs. Liquidity Ratios

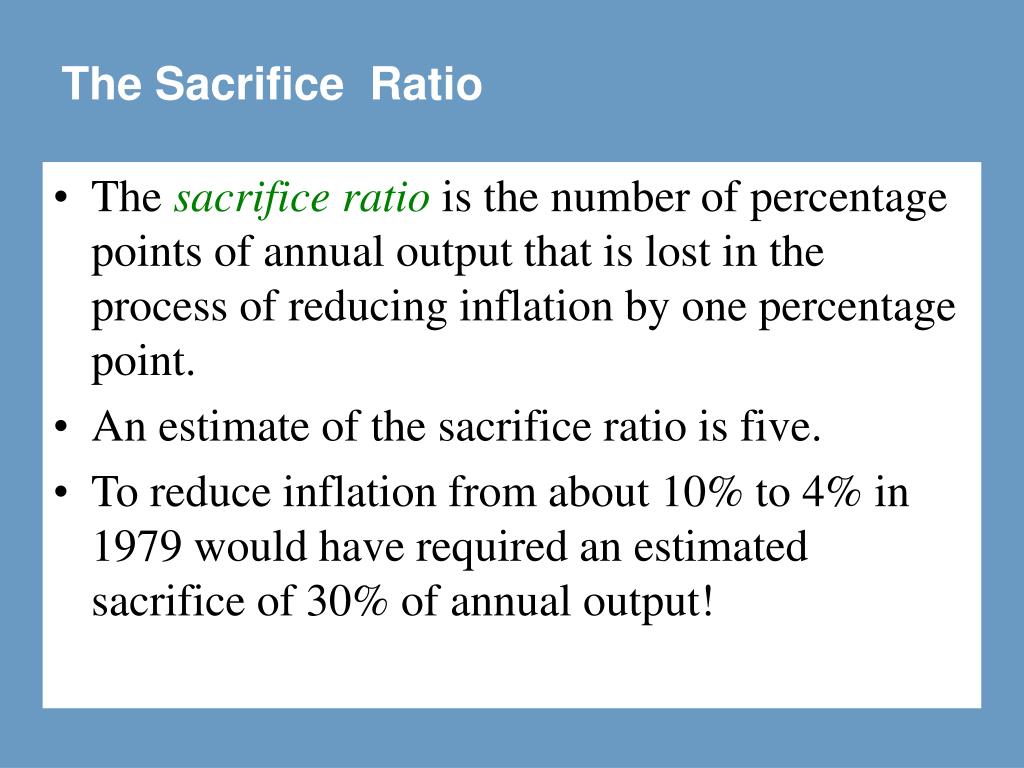

In this section, we will explore historical examples where the sacrifice ratio was put into action, shedding light on the real-world implications of this economic concept. When the results that the slowdown on output has produced an extreme shift in the rate of inflation, steps may be sacrifice ratio formula taken to begin promoting increased output in selected sectors of the economy. A sacrifice ratio is a type of assessment that is utilized to identify the changes that are necessary to the economic output of a nation in order to move the rate of inflation to a more acceptable level.

Economics

This case demonstrates how the sacrifice ratio failed to accurately predict the outcomes in a unique economic situation. Several economic factors can significantly impact the sacrifice ratio, which measures the short-term costs of reducing inflation. These factors play a crucial role in determining the trade-off between inflation and unemployment.

Gaining Ratio Vs Sacrificing Ratio

These reforms led to a decrease in the sacrifice ratio as the economy became more responsive to changes in monetary policy, resulting in lower unemployment rates. Throughout history, economies have faced the challenge of controlling inflation while maintaining economic growth. This delicate balance often requires policymakers to make tough decisions that involve sacrificing short-term growth for long-term stability. The sacrifice ratio is a concept that quantifies this trade-off, measuring the amount of output lost for each percentage point reduction in inflation.

The Sacrifice Ratio and Fiscal Policy

However, the potential reduction in output in response to falling prices may help the economy in the short term, and the sacrifice ratio measures that cost. The sacrifice ratio is a fundamental concept in economics that measures the short-term costs of reducing inflation in an economy. It quantifies the trade-off between short-term costs and long-term benefits of reducing inflation. Policymakers can utilize the sacrifice ratio to make informed decisions regarding the appropriate level of contractionary measures needed to achieve desired inflation targets.

Disinflations, or a temporary slowing of prices, are major causes of recessions in modern economies. In the United States, for example, recessions occurred in the early 1970s, mid-1970s, and early 1980s. Each of these downturns occurred at the same time as falling inflation as a result of tight monetary policy. Thus, to avoid a recession, the government wants to find the least expensive way to reduce inflation. The sacrifice ratio can be considered to be a financial tool that helps to ascertain the proportion of profit that existing partners of a firm has to surrender to favour a newly admitted partner.

- A – A sacrifice ratio helps determine the effect of inflation or disinflation on the country’s production capability.

- Case studies provide valuable insights into the effectiveness of these alternative approaches.

- Looking back at history, we can find examples where countries have faced high sacrifice ratios during periods of inflation reduction.

- In the late 1990s, Japan faced a prolonged period of deflation, with policymakers struggling to stimulate economic growth.

- This helps central banks to set their monetary policies, depending on whether they want to boost or slow down the economy.

However, production levels in the economy are already low in the wake of the Covid-19 global pandemic, even if official unemployment measures fail to record that fact. The labor force participation rate is a better indicator, and that shows that people are not engaging in work at the same rate as before the pandemic. However, the lost economic output cannot be distributed over too many years if the sacrifice ratio is to hold, because the ratio is built using a short-run Phillips curve.

An interesting case study is Japan’s experience with deflation and its impact on the sacrifice ratio. In the late 1990s, Japan faced a prolonged period of deflation, with policymakers struggling to stimulate economic growth. During this time, the sacrifice ratio was estimated to be relatively high, indicating that significant output reductions were required to combat deflation.

It helps to determine the sum of money that would be paid by gaining partners as compensation to sacrificing partners. The Gaining Ratio refers to the share of profit gained by a partner, from the other partners of a partnership firm. Another compelling case that exemplifies the sacrifice ratio is the European Union’s experience during the Eurozone crisis. Following the 2008 global financial crisis, several European countries faced severe economic challenges, including high levels of public debt and mounting budget deficits.